by Jonathan W. Szostek

What’s The Difference Between a 401k and an IRA?

No one wants to feel left behind in the retirement planning race. That’s why setting yourself up for success with retirement saving options that may provide significant tax benefits like an Individual Retirement Account (IRA), and a 401(k) are vital. But how do you know which is right for you, how do you set one or both accounts up, and how do you manage them?

A financial advisor in Annapolis at Scarborough Capital Management is here to help, no matter how far along you are in your retirement planning process. We specialize in 401(k) plan management and explaining the similarities and differences of a 401k vs. IRA.

To help fulfill your curiosity about a 401k vs. traditional IRA, this article covers the basic types of accounts that are out there to give you a good idea of what support you need. While reading this, consider your financial goals, what options you have available, and know that help is available.

What is a 401(k)?

Many employers offer a 401(k), but unfortunately, for a large portion of the working class, they are not required to. This is an employer-sponsored plan, which means you can only have one if your workplace offers it. There are three types of standard 401(k)s to familiarize yourself with: Traditional, Roth, and Solo.

What is a Traditional 401(k)?

A Traditional 401(k) plan is what most people refer as a 401(k) plan. Your payroll department will take contributions to this plan out of your paycheck before taxes, and you don’t pay taxes until you start taking withdrawals in retirement.

What is a Roth 401(k)?

A Roth 401(k) works the opposite of a Traditional 401(k) because you fund the account with after-tax dollars, but qualified withdrawals are tax-free. If you suspect your tax rate will be higher later in life, choosing a Roth 401(k) over a Traditional 401(k) may be suitable. There are no income restrictions, and you can roll the money into a Roth IRA at any time, which can prevent you from having to take Required Minimum Distributions (RMDs) later.

What is a Solo 401(k)?

A Solo 401(k) is technically a traditional 401(k) plan that covers a business owner with no employees or that individual and a spouse. This plan has the same rules and requirements as all other 401(k)s.

Benefits of a 401(k)

A 401(k) plan has many perks, including:

- High contribution limits: For 2022, you can contribute up to $20,500 to a 401(k), but if you’re at least 50, your limit is $27,000.

- Employer-matched contributions: Many employers match 401(k) contributions up to a certain percentage. For example, if you make $100,000 a year and your employer matches your contributions up to 3%, you could contribute $3,000, and your employer would throw in an additional $3,000, bringing your total up to $6,000.

- Pre-tax contributions: Making pre-tax contributions has two significant benefits. It allows you to save more upfront because you’re not paying taxes, and it lowers your adjusted gross income, which reduces your annual tax bill.

What to Know About a 401(k) Plan

There are a few things to be aware of when contributing to a 401(k):

- Vesting period: Some employers require you to stay with the company for a set time before you own your employer match. For example, if your employer contributes $5,000 to your 401(k), but you’re only 25 percent vested when you leave the company after one year, you get to keep $1,250 of the match.

- Required Minimum Distribution (RMDs): With a 401(k) plan, you’re required to start withdrawing from your 401(k) at age 72. Be careful, penalty tax of up to 50% may apply if your yearly RMD is not withdrawn as required.

Types of IRAs

There are many different types of IRAs, but the two most popular ones are a Traditional IRA and a Roth IRA. These are not employer-sponsored and unlike your fellow 401(k); you are required to open these up yourself.

There are many different types of IRAs, but the two most popular ones are a Traditional IRA and a Roth IRA. These are not employer-sponsored and unlike your fellow 401(k); you are required to open these up yourself.

SEP and SIMPLE IRAs are employer-sponsored and are subject to different rules and contribution limits than Traditional and Roth IRAs.

What is a Traditional IRA?

Traditional IRAs are similar to Traditional 401(k)s. You can fund your account with pre-tax money, the earnings grow tax-deferred, and you pay tax when you withdraw the money in retirement. For 2022, you can contribute up to $6,000 or $7,000 if you’re at least 50.

If you or your spouse have access to an employer-sponsored 401(k) (or similar) plan, a Traditional IRA may not be fully tax-deductible. If you do have an employer-sponsored 401(k), your Traditional IRA deductions are phased, based on your Modified Adjusted Gross Income (MAGI) levels.

What is a Roth IRA?

You pay taxes on Roth IRA contributions upfront, then your money grows tax-deferred, and withdrawals are typically tax-free as long as you are 59 ½ or older. Plus, you’re not required to take minimum distributions when you turn 72 as you are with 401(k)s and other IRAs.

Roth IRAs have a waiting period on certain withdrawals, known as the five-year rule. The five-year rule applies to three situations: If you plan to withdraw account earnings, if you converted your Traditional IRA to a Roth, or if a beneficiary inherits a Roth IRA. Failure to adhere to the five-year rule could result in paying income taxes on earnings, withdrawals and a 10 percent penalty.

Roth IRAs also have income restrictions. For 2022, you qualify for a Roth IRA as long as your modified adjusted gross income is no more than $144,000 if you’re single or $214,000 if you’re married.

What is a SEP IRA?

A Simplified Employee Pension (SEP) IRA is a type of traditional IRA designed for self-employed individuals and small business owners.

The main benefit of a SEP IRA is its high contribution limit. For 2022, you can save up to $61,000 or 25% of your salary, whichever is less. This limit is nearly ten times higher than the traditional IRA limit.

If you’re a small business owner with several employees, the IRS requires you to contribute the same percentage to your employees’ plans that you do to your own. So, if you contribute 15% to your SEP IRA, you must also contribute 15% to your employees’ plans.

It may be wise to discuss your options with a financial advisor in Annapolis who specializes in managing 401(k)s and IRAs.

What is a SIMPLE IRA?

A SIMPLE IRA is designed for small business owners with fewer than 100 employees. Unlike 401(k)s that have optional employer matches, SIMPLE IRAs have required matches. Your employer may match your contribution dollar-for-dollar up to 3% of your salary or 2% regardless of whether you use the plan.

Aside from the required employer match, SIMPLE IRAs are similar to 401(k)s. They are funded with pre-tax dollars and you pay taxes on withdrawals in retirement. For 2022, you can contribute up to $14,000 or $17,000 if you’re at least 50.

401(k) and IRA Similarities and Differences

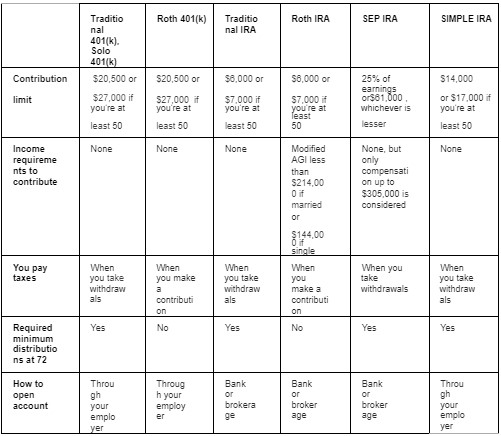

There are many similarities and differences between 401(k)s and IRAs. Use this chart to view each account type at a glance.

Build a Retirement You Feel Proud Of

We understand the jargon can be confusing, and that you have many options at your fingertips. At Scarborough Capital Management, we commit ourselves to helping you simplify the retirement planning process. Whether you’re mid-career and need advice on how to invest your 401(k) dollars, retirement is just around the corner, or you are well into your golden years, we can help you create a tax-efficient strategy that you understand.

The information provided here is general in nature and should not be considered investment, tax or financial advice. Investing in securities involves certain risks which can include the loss of principal invested. Investors should carefully consider all risks involved before investing. Scarborough Capital Management does provide tax or legal advice. You should consult with a licensed professional for advice concerning your specific situation.